delayed draw term loan amortization

More Flexible than Banks Other Lenders. An amortizing loan is just a fancy way to define a loan that is paid back in installments throughout the entire term of the loan.

Advanced Lbo Modeling Test 4 Hour Example Excel Template

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page.

. A delayed draw term loan also referred to as DDTL is a particular feature of a term loan where the lender disburses pre-approved loan amount based on a pre-determined time schedule. Us Financing guide 12. The Payment Frequency setting also impacts the loans term.

Term debt has a specified term and coupon. This CLE course will discuss the terms and structuring of delayed draw term loans. Where the Borrower has both first and second lien secured term loan facilities.

A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. Amortization loans spread the principal payments more evenly distributing the burden over the entire course of a loans life. Each Delayed Draw Loan shall amortize in equal monthly installments in aggregate annual amounts consistent with the amortization grids applicable to Mortgage Loans under the Mortgage Facility in Section 2033a and Term Loans under the Term Loan Facility in Section 2033b as applicable based upon the designation of a given Delayed.

Upon issuance the issuer recognizes a liability equal to the proceeds eg cash received less any allocation of proceeds to other instruments issued with the debt or features within the debt instrument itself. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in. Some loans are weighted unevenly calling for lump payments toward the end of financing periods.

Funded and delayed draw term loans. Basically all loans are amortizing in one way or another. The coupon may be fixed or based on a variable interest rate.

Repayment of Delayed Draw Loans. VICIs revolving credit facility matures on March 31 2026 and can be extended for two successive six-month terms while the delayed draw term loan matures on March 31 2025 and can be extended. Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years.

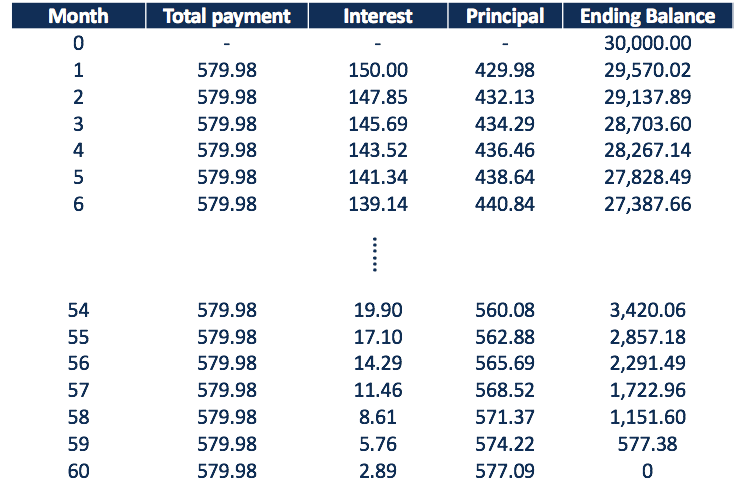

Investment size 5-25 million. The tutorial shows how to build an amortization schedule in Excel to detail periodic payments on an amortizing loan or mortgage. Maturity amortization and size new incremental lenders generally inherit the.

For a term of fifteen years if the payment frequency is biweekly you need to enter 390 for the number of payments. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. Delayed-draw term loans or DDTLs of up to two years are standard features of.

DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional. B Subject to the terms and conditions hereof each Delayed Draw Term Lender severally agrees to make term loans each a Delayed Draw Term Loan to the Borrower during the Delayed Draw Term Loan Availability Period in an aggregate amount not to exceed the amount of the Delayed Draw Term Commitment of such Lender. This contrasts with commitment fees on revolvers of 50bp.

1st Lien Cash Flow Loans. The interest portion of any deferred payment obligation amortization of discount or premium if any and all other non-cash interest expense other than interest and other charges amortized to. Maturities up to five years.

May consist of immediately funded or delayed-draw term loans or of revolving. 3 to 8 Million. A delayed draw term loan is similar to a term loan but features a provision that the borrower can draw certain amounts of the loan at mutually agreed upon times or mutually agreed upon milestones.

It does not include interest. Loan Calculator Templates 7 Free Docs Xlsx Pdf Loan Calculator Car Loan Calculator Amortization Table. Like revolvers delayed-draw loans carry fees on the unused portion of the facilities.

TERM LOAN FACILITY AMORTIZATION SCHEDULE. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Sample Personal Loan Agreement With Collateral Personal Loans Word Problem Worksheets Math Words.

The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first borrowing of Delayed Draw Term Loans on the last day of each March June September and December each in an amount equal to one and one-quarter percent 125. Delayed draw term loan vs term loan Wednesday March 16 2022 Edit. Delayed Draw Term Loans.

As private credit providers flock back to the business of d elayed-draw term loan lending in the wake of the COVID-19 pandemic borrowers may find more restrictive rules governing their use. Lending to Lower Middle-Market Companies. 3125000 plus 1250 of the Delayed Draw Term Loan.

These ticking fees start at 1. The initial term loans and delayed draw term loans will amortize at 1 of the aggregate principal amount of respective loan outstanding balances payable quarterly compared to the previous. 3125000 plus 1250 of the Delayed Draw Term Loan Advance.

Pandemic leads lenders to tighten rules on delayed-draw term loans. All asset lien real estate equipment other fixed assets. Interest-Only with No Amortization.

Working Growth Capital Recapitalization Acquisitions Other Uses. Loan Amount - the amount borrowed ie the principal amount. Can partner with existing senior lender.

Expansion dividends buyouts refinancings etc. Payment Date Last Business Day of Principal Amortization Payment. Number of Payments term - the length of the loan.

Loans are issued under a variety of terms requiring borrowers to meet myriad repayment conditions. For example you can have loan withdrawals taking place every three months or six months or at other intervals agreed by the lending institution.

Amortization Schedule Overview Example Methods

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Update 1 Pg E S Revised Dip Facility Clarifies Minimum Asset Sale Sweep Threshold Term Loan Pricing Lowered Reorg

Pdf Loans Amortization With Payments Constant In Real Terms

Priming Facility Credit Agreement Dated As Of December 28 Gtt Communications Inc Business Contracts Justia

Exploring The Pros Cons Of 1l 2l Vs Unitranche Financing Structures Penfund

The Term Loan Credit Agreement Dated As Of May 26 2021 By Atkore International Group Inc Business Contracts Justia

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Delayed Draw Term Loans Financial Edge

Loan Amortization Schedule How To Calculate Accurate Payments